Why is the depreciation of the financial year shown in the?

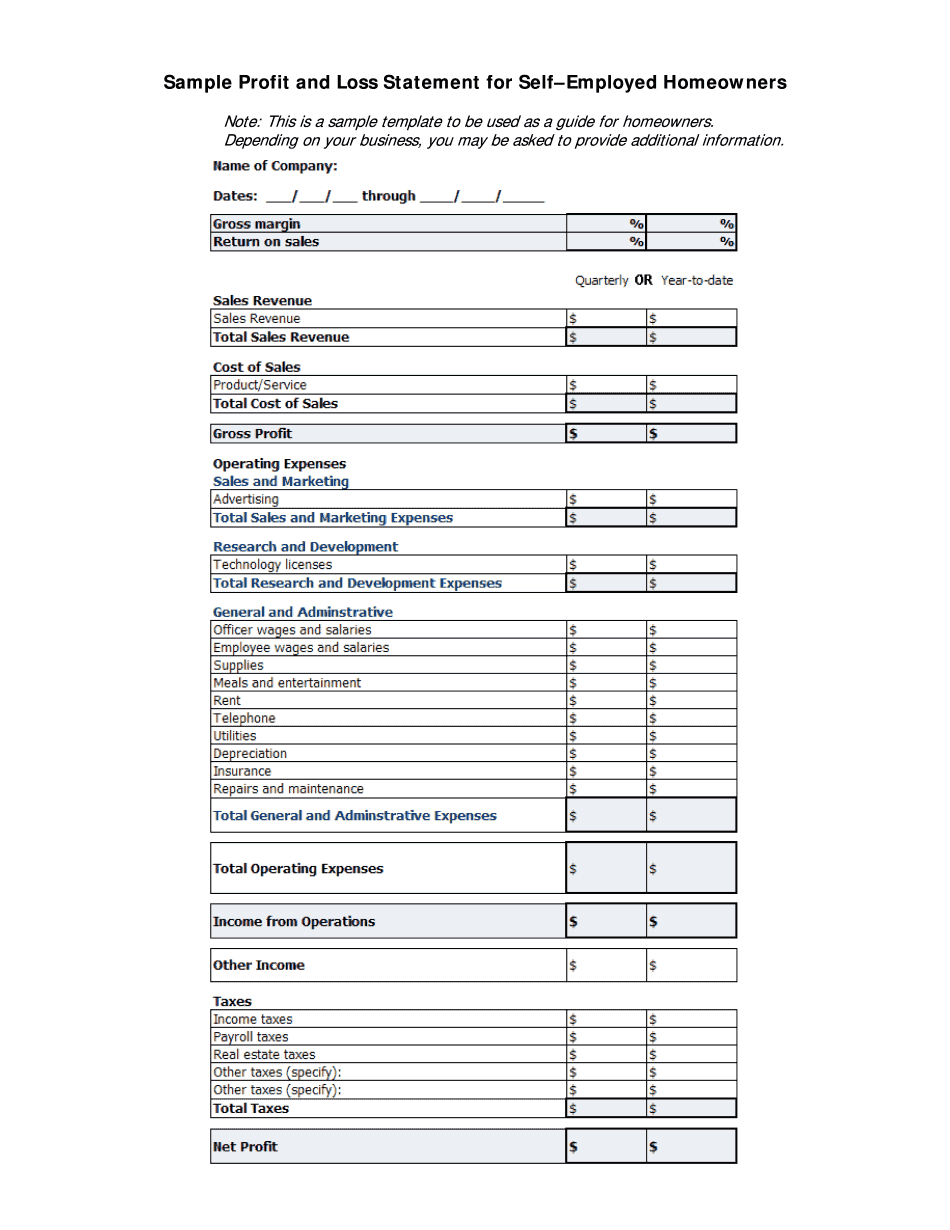

Depreciation for the current year is considered an expense and, like all expenses for the financial year, need to be shown on the P & L. As each year passes, the current year's Depreciation Expense gets added to Accumulated Depreciation (most companies do this each month rather than once a year). Accumulated Depreciation, just as it sounds, is an accumulation of all depreciation for an asset. The reason Accum. Deprec. is shown on the Balance sheet is because it is reducing the (book) value of an asset. And all asset (book) values are shown on the Balance Sheet.