The profit and loss statement shows you your business's income and expenses over a period of time. You can access your profit and loss statement by selecting reports from the nav bar on the left and then clicking profit and loss underneath favorites. The profit and loss statement shows you how much money your business made and spent over the displayed period of time. At the top of the profit and loss statement, you see your business's income, displayed right here, divided up into different income accounts. This allows you to see your general revenue streams. You also see your cost of goods sold, which are costs specifically for the production of goods that you sold or services that you charge your customers for. Towards the bottom of the profit and loss are your expenses. These are expenses for the general maintenance of your business, such as advertising, insurance, rent, and utilities. The profit and loss statement allows you to see your total income minus your cost of goods sold, and then also minus your expenses to display your net income. This is your profit over the selected period of time. Now, let's take a look at the balance sheet by going to reports and then balance sheet. Scroll down to the bottom of the balance sheet to the equity section. Here, we can see the exact same number that was displayed on the profit and loss statement before. So, the end result of the profit and loss statement is also displayed on the balance sheet. The net income or profit of a business is used to calculate the growth in what the business is worth to the owner, because it's in the equity section of the balance sheet. Use the profit and loss statement to measure the basic profitability...

Award-winning PDF software

2018 Profit And Loss Template Form: What You Should Know

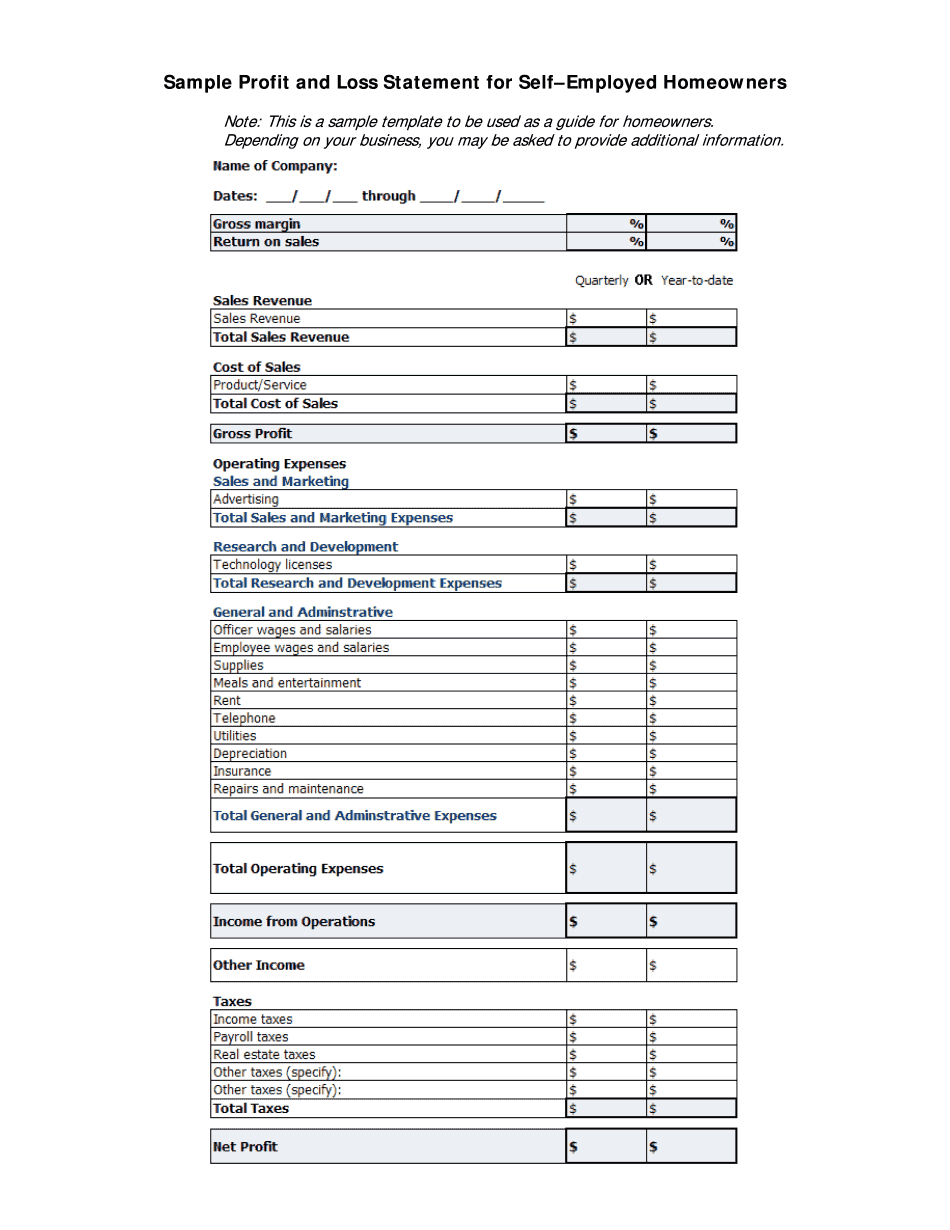

Form 1040). Department of the Treasury. Internal Revenue Service (99). Profit or Loss From Business. (Sole Proprietorship). Prior Year Products — IRS Results 1 – 97 of 97 — Inst 1040 (Schedule C), Instructions for Schedule C (Form 1040 or Form 1040-SR), Profit or Loss From Business (Sole Proprietorship), 2019. Free Profit And Loss Templates — Smart sheet 2016 Schedule C (Form 1040) — IRS SCHEDULE C. (Form 1040). Department of the Treasury. Internal Revenue Service (99). Profit Or Loss From Business. (Sole Proprietorship). Prior Years Products — IRS Results 1 – 97 of 97 — Inst 1040 (Schedule C), Instructions for Schedule C (Form 1040 or Form 1040-SR), Profit Or Loss From Business (Sole Proprietorship). 2 2 and so on…. 2018 Schedule C (Form 1040) — IRS SCHEDULE C. (Form 1040). Department of the Treasury. Internal Revenue Service (99). Profit Or Loss From Business. (Sole Proprietorship). 2 2 and so on…. 2017 Schedule C (Form 1040) — IRS SCHEDULE C. (Form 1040). Department of the Treasury. Internal Revenue Service (99). Profit Or Loss From Business. (Sole Proprietorship). Prior Years Products — IRS Results 1 – 97 of 97 — Inst 1040 (Schedule C), Instructions for Schedule C (Form 1040 or Form 1040-SR), Profit Or Loss From Business (Sole Proprietorship), 2 2. 2025 & 2019 Free Profit And Loss Templates — Smart sheet Mar 26, 2025 — Use this simple Profit & Loss Statement for nonprofit organizations. A profit and loss statement is one set of business accounting figures that is required by U.S. tax law as a part of filing your annual income tax return. A profit and loss statement is a statement of the income or losses made on a specific business activity. Profit, loss, and cash flow are the three main types of business revenue, or cash flow in any industry with constant profit/loss. Profit & Loss Statements are also used as an analytical tool to document and manage the financial operations and strategies of a business.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form profit and loss satement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form profit and loss satement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form profit and loss satement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form profit and loss satement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 Profit And Loss Template