If you want to understand your company's profitability, then you need the income statement. The income statement shows you your profitability for a period of time. It could be a day, a week, a month, an entire quarter, or a year. For most small businesses, you're going to be looking at your income statement over the period of a month and then you'll be sitting down with your accountant at the end of the year to look at the entire year. The income statement calculates profitability by adding up all of your sales in the period and then subtracting all of your expenses in the period. Sales minus expenses is equal to net income. If net income is positive, you're profitable. If net income is negative, then you suffered a loss and you're not profitable. Let me show you a quick example. Let's say that in January, we had a total sales of $10,000 and that all of our expenses added up to $8,500. If we subtract the $8,500 from $10,000, we'll end up with a net income of $1,500, which, because it's a positive number, means that we've been profitable. Alright, so just before we go into showing you what a loss might look like, a couple of things to make this income statement look a little bit better. Anytime we have a mathematical function like adding some numbers or subtracting one number from another, we put a single line, which means here that the $10,000 gets subtracted from the $8,500 in order to equal the $1,500. And then at the bottom of any financial statement, the last number has two lines underneath it, a double underline. Now let's see what happens when our expenses are greater than our sales. Let's say sales of $10,000 and expenses were $12,000. We're going to do...

Award-winning PDF software

Profit And Loss Statement for small business PDF Form: What You Should Know

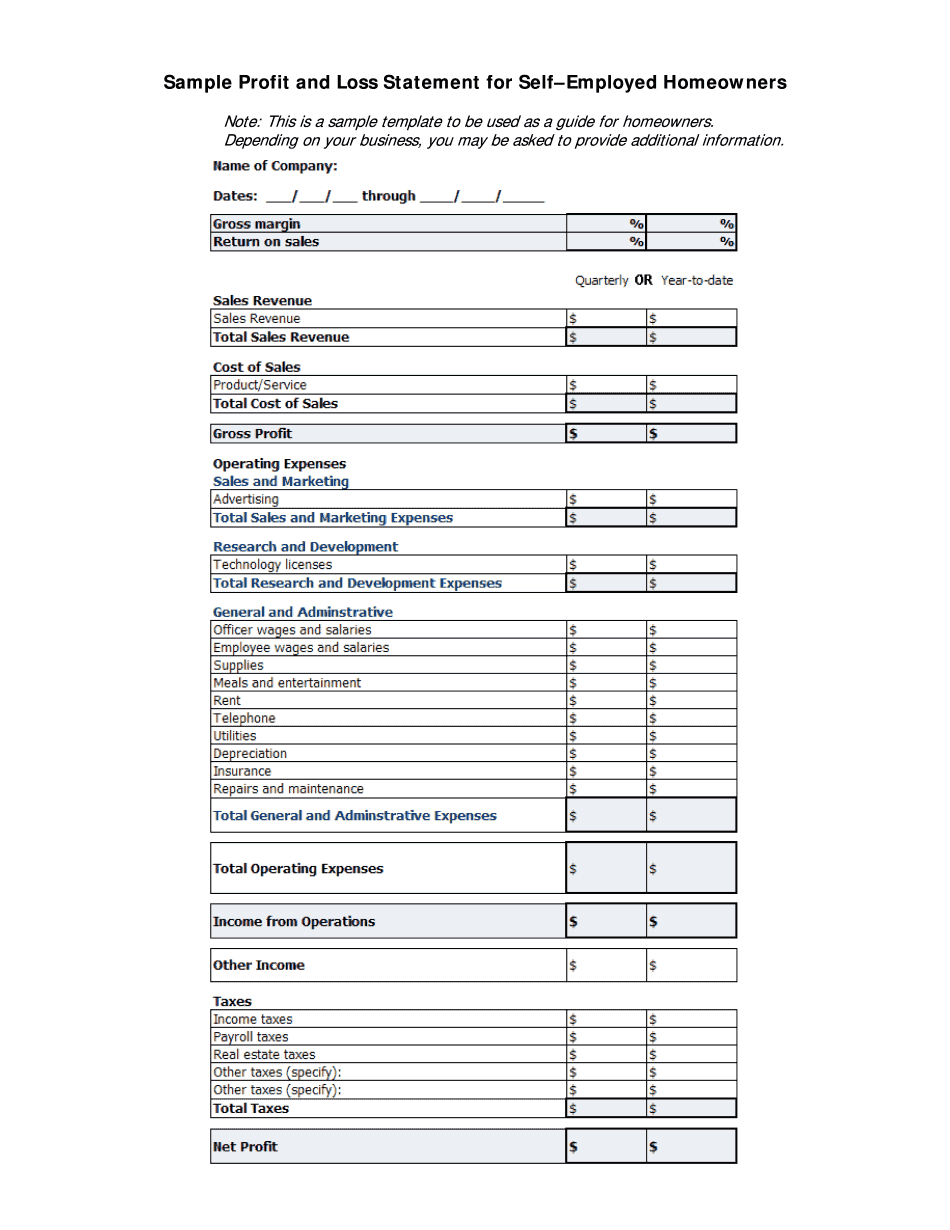

All the information necessary to complete this form is included. Proprietor Statement The proprietorship form is used when the owner of a proprietary is a sole proprietor or an independent contractor or both. If you are self-employed, you should complete this version. If your partner owns the place, sign and fax or print the other version. If a third party owns the place, sign and fax or print the corresponding version. Copy and print. Profit and Loss Statement — CFPB The CFPB profit and loss statement allows you to report your financial information in one easy to fill form Proprietor Statements — EIN For profit or loss from a business entity as defined by the Small Business Administration (SBA,). Enter a description of that entity. Enter the type of business entity, a state you live in, and the name of the business entity. For self-employed, enter self-employed, and/or workman/woman. For non-proprietary, enter trade name. Name of a principal employee (person) For each transaction, state which portion of the total was paid to the principal. For each transaction, describe the transaction. Payment date (Optional) If the business entity is owned by a third person or if the owner has no spouse, child, or family member who is on the file, enter the names and address of the third person on the line below. You can choose whether to include a spouse if the person is married or you don't know the names or addresses of the person(s). How are the financial statements presented? What is included in your financial statement: Businesses that make at least 10 million dollars in annual revenue must provide a complete Profit and Loss Statement annually. A business that has an EIN must provide it on the business side of the EIN. All small businesses that are taxed as individuals with a single entity EIN must include a full Schedule C each year. Each EIN must be dated before the end of the tax year in which it was filed, and you must send it to us by June 1st of each year. We'll enter the data into our system and send you your tax return. The IRS requires us to send you three financial statements that include your net profits for the tax year and your net losses for that tax year.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form profit and loss satement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form profit and loss satement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form profit and loss satement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form profit and loss satement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Profit And Loss Statement for small business PDF