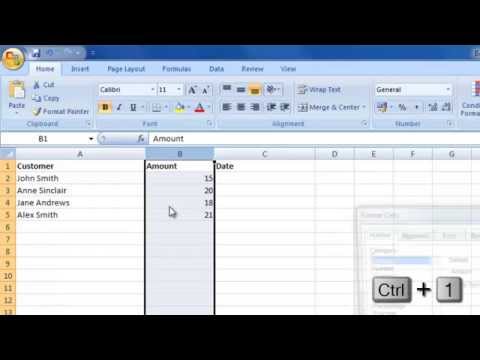

In this lesson, we're going to be looking at creating an income and expenditure spreadsheet. So, let's assume, for example, you are self-employed and you want to have a spreadsheet that will enable you to log all of your income, expenses, and net profit. Okay, so let's begin by opening up Microsoft Excel. We have three sheets as standard: Sheet 1, 2, and 3. Now, down at the bottom, I'm just going to double click on Sheet 1 to rename it, and this will be renamed to "Income." In our income sheet, let's have a few columns. The first column will be called "Customer," the second column will be "Amount," and the third column will be "Date." Let's resize these columns a little bit. Now, in the customer column, we can have some fictitious customers. Let's say you run a complementary therapy business and all of your customers are individuals. So, we can have John Smith, Sinclair, Jane Andrews, and Alex Smith. In the amount column, let's say the first person paid us 15 pounds, the next person paid 20 pounds, the third person paid 18 pounds, and the final person paid 21 pounds. In this column, I want the amounts to be displayed as currency. So, if I click on the column header B, it will select all of column B. Then I can use the keyboard shortcut Control + 1 to bring up the format cells option. I can choose currency with two decimal places and click OK. This will make the amounts appear as currency. I am going to select the whole column again by clicking on B and center align the amounts to make them easier to read. The date column will contain the dates that we received the payments. For example, the first payment might be on...

Award-winning PDF software

Profit And Loss Template For Self Employed Form: What You Should Know

Form and Guide to calculate business Net Profit or Loss Forms and guides to calculate net profit, loss, profit or loss, net income, loss, profit, net income, losses, profit of business. These numbers are a result of investment in capital and property, and business expenditures. Basic Business Model in a nutshell If you want your business to succeed, but also you have no ideas how to go about it, you may find the below articles from The Guardian interesting.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form profit and loss satement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form profit and loss satement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form profit and loss satement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form profit and loss satement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Profit And Loss Template For Self Employed