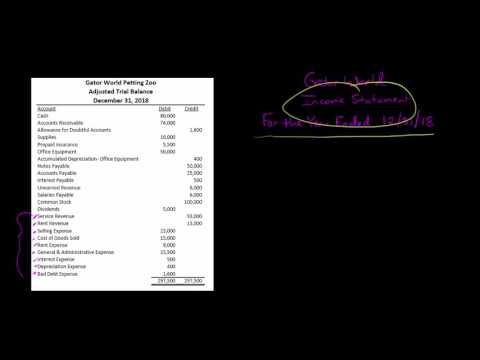

In this video, we're going to talk about how to create a single-step income statement. A single-step income statement only has one step, which is subtracting all the expenses from the revenues to determine the net income. Let's use an adjusted trial balance for our example. The company we'll be using is Gator World, a petting zoo for alligators. We've already made all the necessary adjusting journal entries, and this income statement will be for the year ended December 31st, 2018. To start, we need to identify which accounts will go on our income statement. We only want revenues and expenses, so we'll include service revenue, rent revenue, selling expense, cost of goods sold, rent expense, general and administrative expense, interest expense, depreciation expense, and bad debt expense. Accounts like cash and receivables belong on a balance sheet, not an income statement. Now, let's put together our actual income statement. We'll start with the heading "Gator World Income Statement" for the year ended December 31st, 2018. Remember, you can also create an income statement for a specific quarter, but for this example, we'll focus on the entire year of 2018. Using the single-step method, we'll proceed to list out all the revenues. In this case, we have service revenue of $93,000 and rent revenue of $13,000. The order of listing these revenues doesn't matter, we are just ensuring that we include them all. So the total revenues for Gator World is $106,000. Next, we move on to the expenses. We have selling expense of $23,000, cost of goods sold of $15,000, rent expense of $9,000, G&A expense of $23,500, interest expense of $500, depreciation expense of $400, and bad debt expense. Since the text was cut off, we are unable to provide the amount for bad debt expense. Once we have listed out all the...

Award-winning PDF software

Income statement template word Form: What You Should Know

Direct Roll Over into another IRA or Roll over as a rollover to another IRA Note: In some cases, a “no distribution” notation may appear for a distribution that is reported on Form 5498. This notation may be a result of the distribution being under the control of the designated beneficiary, or of a distribution being deemed non-qualified because the account is not required to meet certain required minimum distributions. Taxable Amount Not Determined The taxpayer is not required to allocate or deduct any interest or penalty. This means we do not treat the distribution as taxable. Note: In some cases, if you plan to roll over assets to a Roth IRA, these distributions are taxable: If: You have a joint retirement plan, your employer provided benefits will be tax-exempt. The assets being transferred are exempt because they are not considered retirement accounts. You have a Roth IRA for yourself; a separate Roth IRA for each spouse. The assets that you are transferring are either not tax-exempt and are not subject to a tax, or are tax-exempt and subject to a 10% withholding rate. If: You have a traditional IRA for yourself; and You will not be able to roll over your traditional IRA to a Roth IRA later, and you do not plan to withdraw the funds from your traditional IRA because of a need to pay your taxes later. Example: You roll over 15,000 of your traditional IRA to your Roth IRA in early 2018, and the tax rate on this transfer is 10%, and you will not be able to withdraw 2,500 of this IRA before early 2019. The distribution would, therefore, be taxable. The same is true if you transfer 5,000 of your traditional IRA to a Roth IRA and you will not be able to withdraw 50,000 from your Roth IRA before early 2019. The Distribution Is Not Tax-Deductible The distribution is not tax-deductible. Exception: In 2017, you can roll over your nonqualified distributions from an IRA into a qualified plan or an eligible retirement plan. You can then deduct any qualified distributions from that plan that you qualified for but were not eligible to roll over into a qualified plan. If you need to roll over nonqualified IRA distributions into a Roth IRA for the purpose of making a qualified distribution from your Roth IRA, the distribution is nondeductible and cannot be subtracted from your gross distribution from the Roth IRA.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form profit and loss satement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form profit and loss satement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form profit and loss satement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form profit and loss satement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Income statement template word