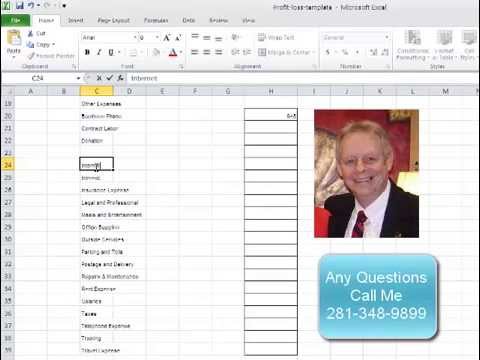

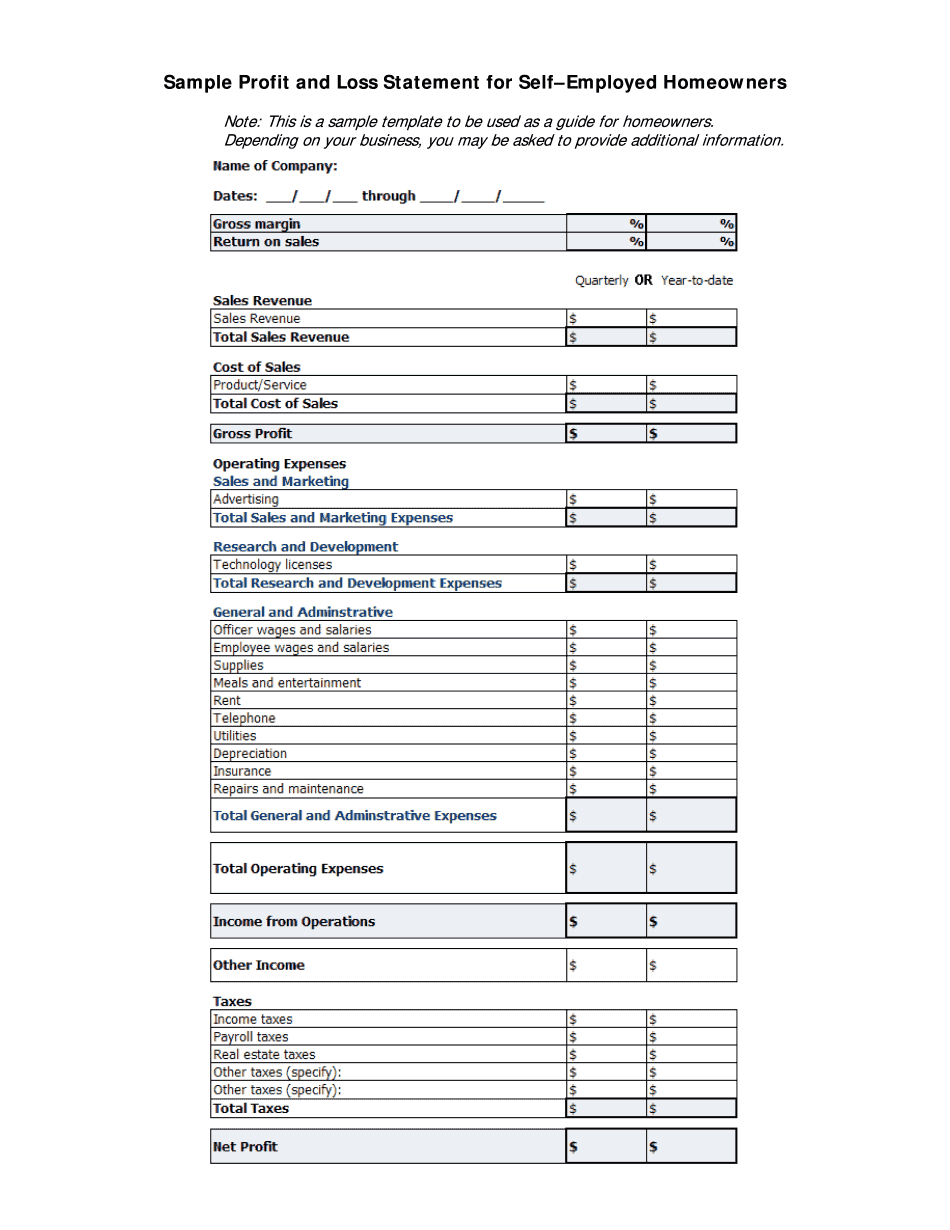

Hey, this is Mike Durer. Listen, I wanted to go over this information for you. A lot of times, when you're self-employed, an underwriter is going to require that you have a profit loss. Now, there are two situations that come up. One is when you haven't filed your income taxes for the previous year, and the other one is when they want to see the equivalent of how you've done in any specific time during the year. Normally, a good category for this time period is quarters. So, the one I'm going to go over today is for the year of 2013, but it could equally be the first quarter of 2014. The underwriter would want to see what your income is. The source of the data that we're going to put in here could be your checkbook or the receipts that you get in. The best way to do this is to use a previous tax return if you've been self-employed for any length of time to show consistency with your Schedule C, which is the profit loss for your business when you file your tax returns. So, anyway, what I wanted to show you is that here you've got your income. Now, you could categorize your income. It's not necessary, but you could put income from one type of job or income from a different type of job. If you're in the retail business, it might be your total sales income. And then, if there is a cost of goods, you see here we put a number here for materials, labor. I mean, these can be anything that you want. And then, what you look at is you say, "Okay, this was my gross sales. These were some deductions that might have come out of there, like the...

Award-winning PDF software

Simple Profit And Loss Template For Self Employed Form: What You Should Know

Sample Profit and Loss Statement for Personal Use: Sample Profit and Loss Statement for Personal Use– Smart Sheet May 10, 2025 — Download Self-employed Profit and Loss Statement Templates — Excel In this Excel-friendly template, you can easily generate a profit and loss statement for your own business. The template features two sections: Profit & Loss Statement and W-2 Summary. Basic Profit and Loss Statement for Firms and Individuals Free May 25, 2025 — Download Profit and Loss for Self-Employed Borrowers — Excel. In this free Excel-friendly profit and loss example, you can easily generate a profit and loss statement for your own business. The template features two sections: Profit & Loss Statement and W-2 Summary. Sample Profit and Loss Summary for Personal Use: Sample Profit and Loss Summary for Personal Use — Smart Sheet December 19, 2025 — Download a Profit and Loss Example for Individuals & Small Firms Free The Basic version of our Profit and Loss example for self-employed individuals and small firms can be downloaded here. This is a perfect guide for individuals who are trying to run a small business as well as for those in the self-employed category interested in writing up a profit and loss statement report for the business or an individual. The self-employment template is designed to be used with Microsoft Excel. Profit and Loss Summary For Real Estate Investment Properties Free May 19, 2025 — Download a Profit and Loss Example for Real Estate Investment Properties Free In this version, the basic profit and loss examples can be downloaded here. The basic concept is: if the investor makes money on the purchase of the property during one year and makes a loss on it two years later, how far will he or she is able to recover from the loss and how much of the profit will be returned to the investor? Basic and Intermediate Profit and Loss Example Free September 07, 2025 — Download Profit and Loss for Self-Employed Borrowers– Microsoft Excel. In this free version, the basic and intermediate profit and loss examples can be downloaded here. This is a perfect model for those who are trying to run a small business as well as for those who are interested in writing up a profit and loss statement report for the business or an individual. The short description of the business and personal income and expense statements from the tax return will be added, plus a table showing the total amount of gross income (Gross) paid to the owner during the year (Gross).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form profit and loss satement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form profit and loss satement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form profit and loss satement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form profit and loss satement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Simple Profit And Loss Template For Self Employed