Hey guys, I have a video for you today about keeping track of your finances. This video will help you keep track of what you're buying, how much it's selling for, the cost of the item, eBay PayPal fees, and how to determine if you're making a profit or losing money. Let's go ahead and start by creating a spreadsheet on Sheets. It's absolutely free to use, but you might need to create a Gmail or account, which doesn't cost anything. The great thing about using Sheets is that it's online, so you can access and work on it from anywhere. Let's get started: 1. Go to the Sheets main page. 2. Click on "Sheets" and create a blank document. 3. Title your document however you prefer. For example, "July Sales." 4. Adjust the columns to have a larger space for the first column, which will be used for the item name. 5. Label the remaining columns accordingly.

Award-winning PDF software

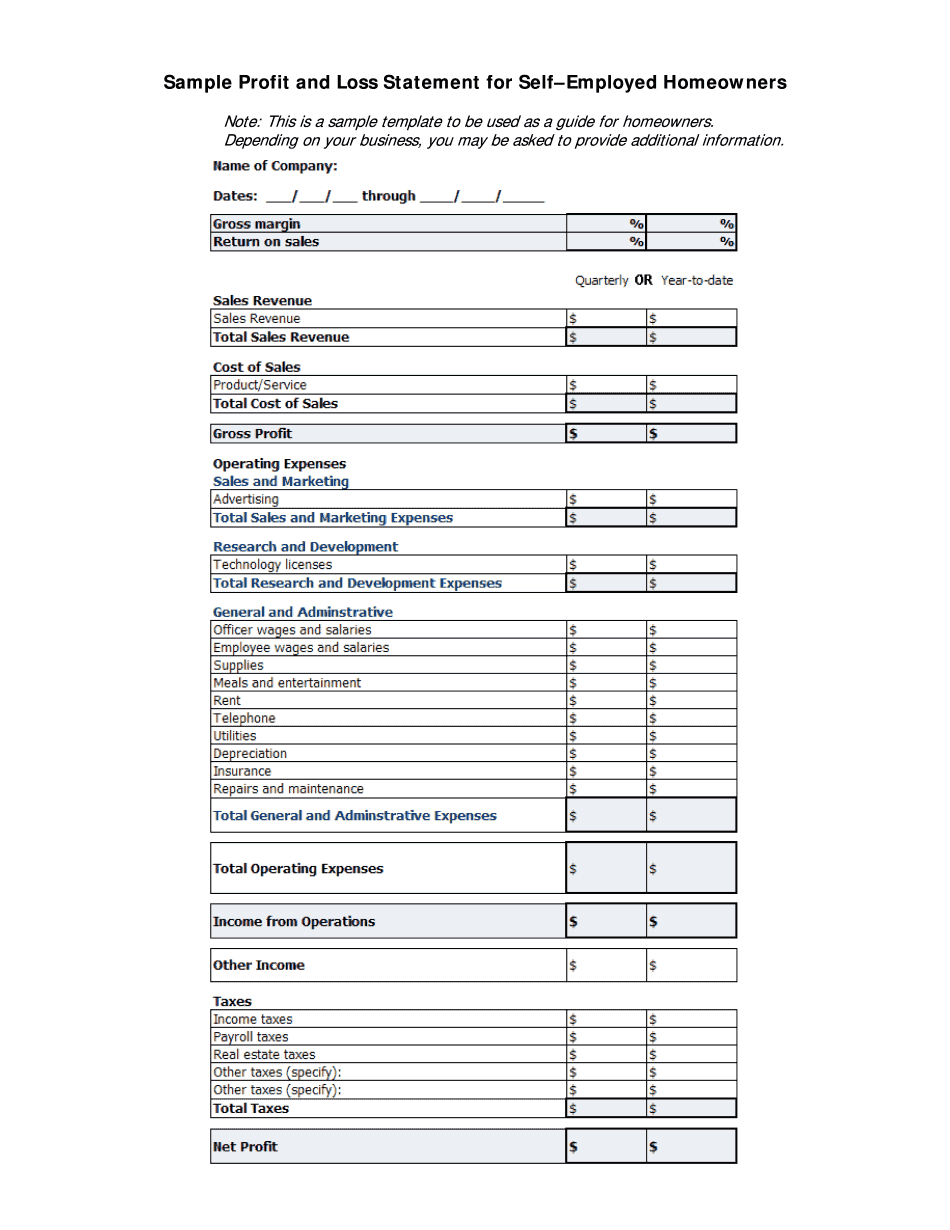

Profit And Loss Statement google spreadsheet Form: What You Should Know

Click below for more Google sheets profit and loss templates Google sheets for Profit and Loss. The Google Sheets for Profit and Loss Template. P&L Spreadsheet. Profit and Loss Spreadsheet. Google Sheet for Profit and Loss. This page is a Google Sheets Profit and Loss Statement template. In this Google Sheets Template you will find detailed P&L statement template and profit and loss statement for different industry verticals. You can easily modify the data with your own formulas. Profit and Loss Statement. P&L Spreadsheets. P&L spreadsheet. P&L Spreadsheet. P&L Excel. Profit & Loss P&L Templates. This one-page Google Sheets profit and loss template. This Google Sheet P&L Spreadsheet template has only the raw profit and loss statements, but it includes all necessary calculations for the calculation. What type of income is included in the earnings and cost? How much is the P&L? What is the gross margins? How much does it take to create the P&L? Is it free? What costs to create a P&L are included? What is included in the cost? How many sales does it take, and what do the margins cost? How many sales do you need for the cost? What is the margin cost? How do you know if you have created the correct P&L? What is the P&L table? And finally, how much do you have taken? Step by step P&L creation instructions. Step by step Profit and Loss template instructions. Google sheets Profit and Loss Statement Google sheets Profit and Loss template for any industry vertical. Google Sheet P&L Template. Profit and loss spreadsheet Google sheets profit and loss spreadsheet. Profit & Loss Spreadsheet. Spreadsheet P&L Profit Template. This is the Google Sheet Profit and Loss Statement template for Profit & Loss. P&L. This is the Google Sheet P&L Statement template for P&L. P&L Spreadsheet. P&L spreadsheet. Profit & Loss Spreadsheet. Google Sheet Profit & Loss template. This is the Google Sheet P&L Statement page. P&L Spreadsheet. Google Sheet P&L Statement Page. This is our Google Sheets P&L Template. Profit and Loss Statement for Profit & Loss. P&L Spreadsheet. Google Sheet P&L Statement Spreadsheet.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form profit and loss satement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form profit and loss satement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form profit and loss satement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form profit and loss satement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Profit And Loss Statement google spreadsheet