Award-winning PDF software

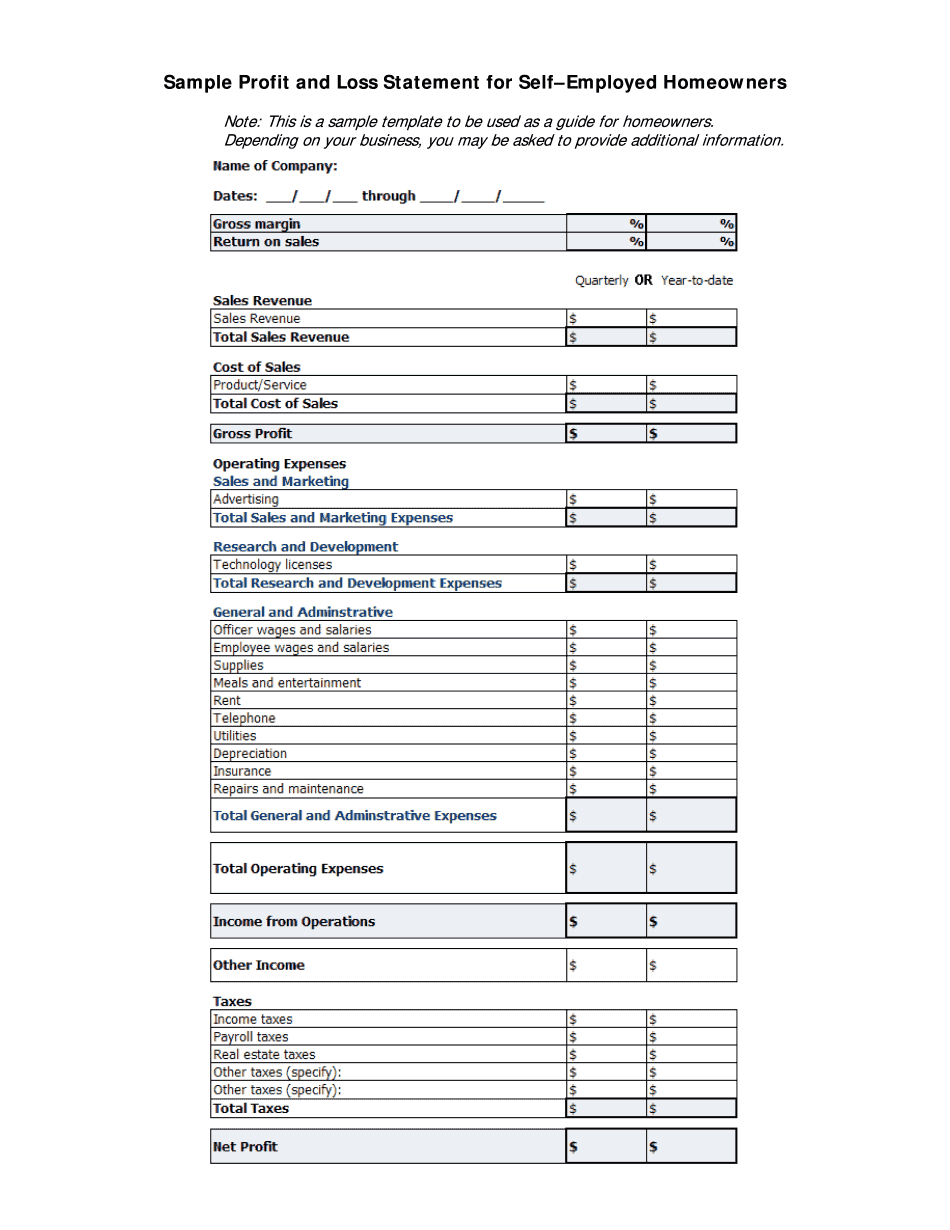

Personal Profit And Loss Statement Template Form: What You Should Know

Gains, losses and the income statement Gains, losses and net income Gains, losses, and capital expenditure Gains, losses, and tax consequences of business decisions Gains, losses, and tax considerations Gains, losses — a balance sheet A gain or loss is a financial result that can be either positive or negative. Most business owners have experienced some form of a gain or loss, but the question of how to record This is difficult. This is where a balance sheet comes in. This document is basically a record of each event over time — how much was earned and how much was spent. A cash flow statement is not necessarily necessary when you follow this guide. The information you get from a cash flow statement includes: Accounts, loans and borrowings; cash flows for all items in the business; net income and cash flow analysis; net interest; and interest paid, capital lease termination, property disposed and asset disposals. The cash flow statements help to estimate the amount of income and cash that comes in and out of your business every day. It helps you make business decisions and determine whether you need to make a cash payment to a customer. A cash flow statement is useful if you have lots of accounting information, such as a profit and loss statement. Example of a cash flow statement Example of a cash flow statement — Google Net income This is revenue minus expenses. Net income helps you calculate profit. Net income is reported on your income statement or annual statement, which is how you'll see its effect on your profit and loss statement. Example of a cash flow statement Net income and profit Records of all the income and expenses that your business generates. These records include all income for the month, and also includes the net income for the year. It can also be included on an expense statement to show the effect of the revenue. Example of a cash flow statement Net interest It's an addition to a cash flow statement to show how much interest you have paid during the period (which would include interest on borrowed money as well).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form profit and loss satement, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form profit and loss satement online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form profit and loss satement by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form profit and loss satement from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.